The house buying process is no easy undertaking. Especially saving for a mortgage.

So, a few tips and tricks for saving would probably come in handy. Well, aren’t you glad you’re reading this article?

Our pals over at Perfect Property were kind enough to share some of their expert tips for when you’re saving for a mortgage.

Keep an eye out for free events on around the city

First things first, saving for a mortgage doesn’t mean you totally give up your social life and never go out and have fun.

Yes, we have to make some sacrifices, but it’s important that we still live our lives. So, make sure to keep an eye out for free things going on in the city, because there’s no shortage of them.

We are hosting a series of free brunch clubs and summits for first-time buyers, all of which you can keep an eye out for on our AIB Livin Dublin hub.

Pay off all of your debts

The less debt you have, the easier it will be to save for and manage and save for a mortgage.

Try to pay off high-interest credit cards, personal loans, and similar debts. Having such debts paid off would make you more appealing when getting pre-approval by a bank or lender.

Existing debt can limit the amount of money they are willing to lend you.

Create the perfect night in

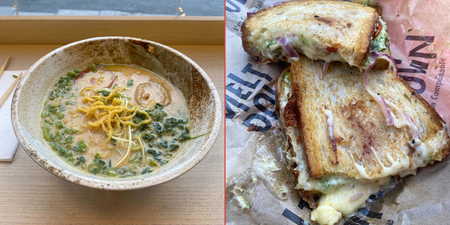

If you’re sacrificing a few meals in restaurants and nights out in town when you’re saving, there are some super fun alternatives. Create the ultimate night in and you won’t even be thinking about what else you might be missing out on.

Get yourself a nice bottle of wine, whip up a delicious cheeseboard and some homemade snacks, pull out every blanket and duvet in the house, stick on a wholesome movie and enjoy.

Good food and good company, sure what else do you need?

Open a deposit-only savings account

Having an account solely dedicated to saving for a mortgage will make it easier to manage your savings and have defined goals.

The type of account you choose to set up is important. Make sure you take some time to research what is available and which one will suit you best.

Then, set it up as a recurring deposit and you’ll move closer to your goal without even noticing.

Look at where your spending happens

Saving for a mortgage is difficult when you don’t know where most of your money goes.

Sit down and work out where most of your spending happens to find out where you can and should cut down.

Then, consider where else you can cut down. How can you become more energy efficient to lower bills? Can you renegotiate a lower rate with your credit card, insurance and internet provider?

Meal Prep

Listen and listen good: stop buying expensive lunch every day on your break!

After examining your financing and discovering where your spending happens, you’ll probably find that this is the area where you could make some serious cuts, and it doesn’t have to make lunchtime any less exciting.

Get creative and batch cook a tasty meal for the week ahead. We live in 2020 and YouTube has probably well over a million videos that’ll provide you with simple yet exciting meal-prep ideas.

If you’re a first-time buyer, you’ll definitely want to check out our AIB Livin Dublin hub, which houses all of the most relevant information, top tips, Dublin area guides and updates on our free first-time buyer brunch clubs and summits.